(This article is attached with English translation)

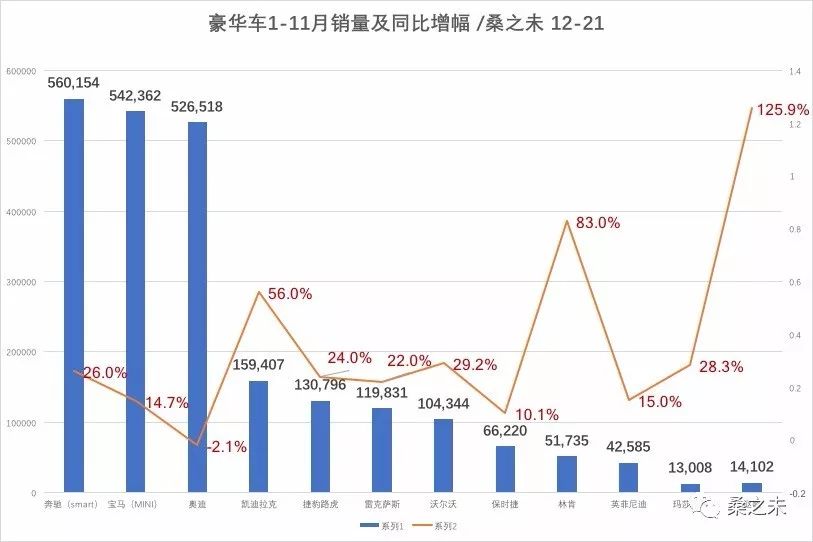

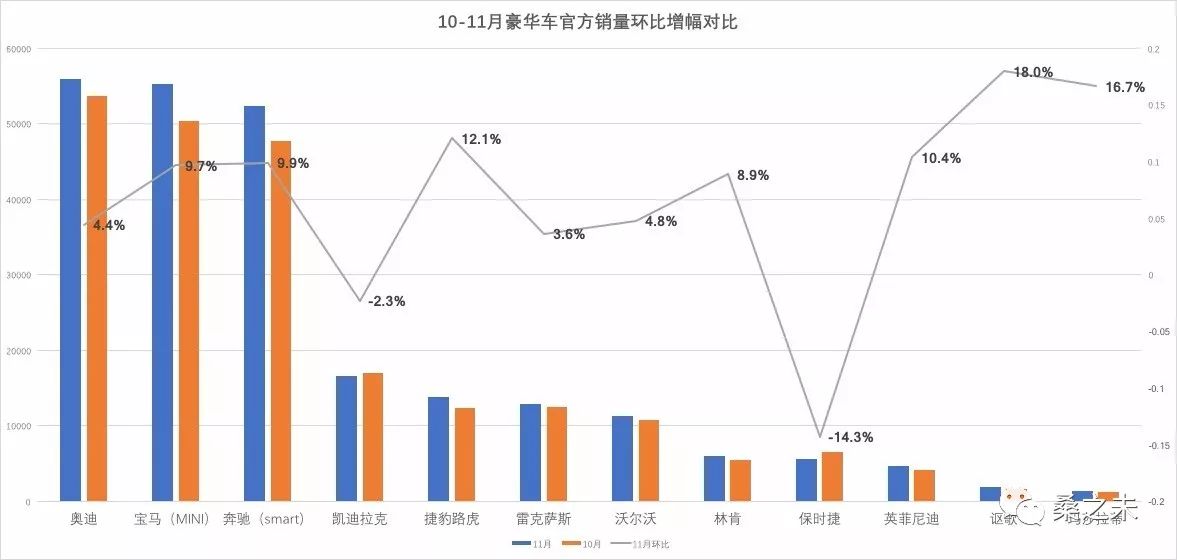

2017年11月12个豪华车品牌官方公布的销量为237,848辆,同比增长13.1.%,环比增长6.5%(10月因国庆长假少了1周有效销售日);经销商零售市场销量为23.2万辆市场,豪华车市场份额为11%。 1-11月累计销量为2,331,062辆同比增长17.5%。11月豪华车市场增长保持稳定,预计12月份豪华车销量仍然保持20万多辆的销售规模,全年累计250多万辆,市场份额11%左右。

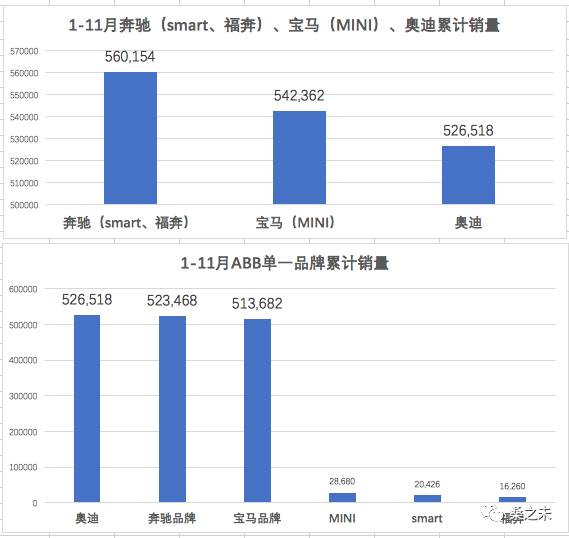

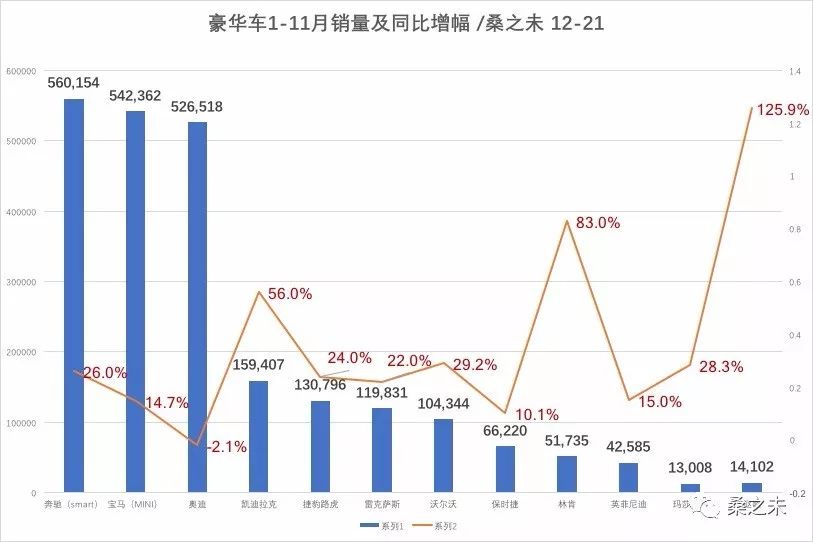

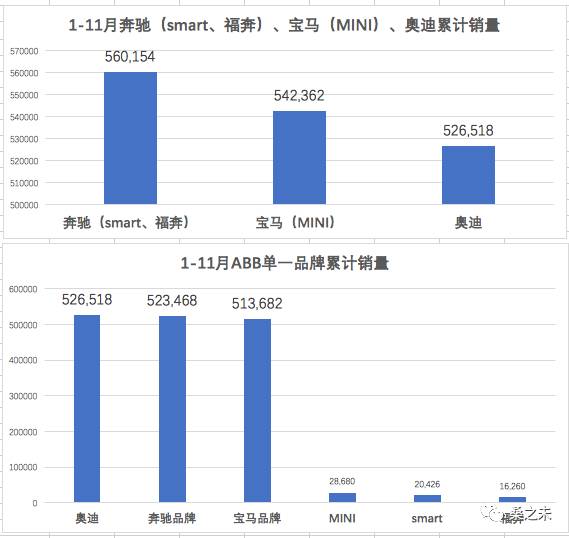

距离全年销售结束还差1个月,谁家问鼎销量冠军仍有悬念,奔驰(含smart,福奔)截止11月份全年累计销量为560,154辆;宝马(含MINI)为542,362辆;奥迪为526,518辆。按单一品牌来计算,奥迪领先奔驰、宝马。奥迪2016年销量为58.9万辆,预计今年全年能达到59万辆左右;奔驰、宝马今年全年销量已经完成,12月份将会保持5万辆左右的规模,预计2017年按销量总数计算奔驰将会第一,如果按单一品牌计算奥迪会保持第一,其实销售数字并不代表一切,销售质量才是关键。

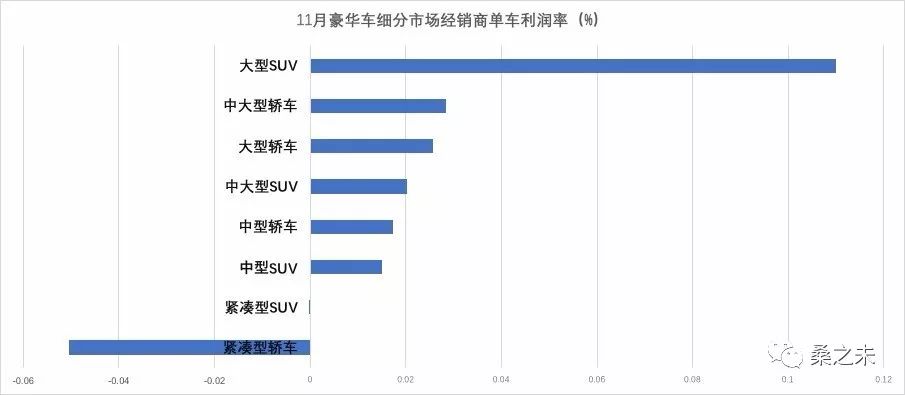

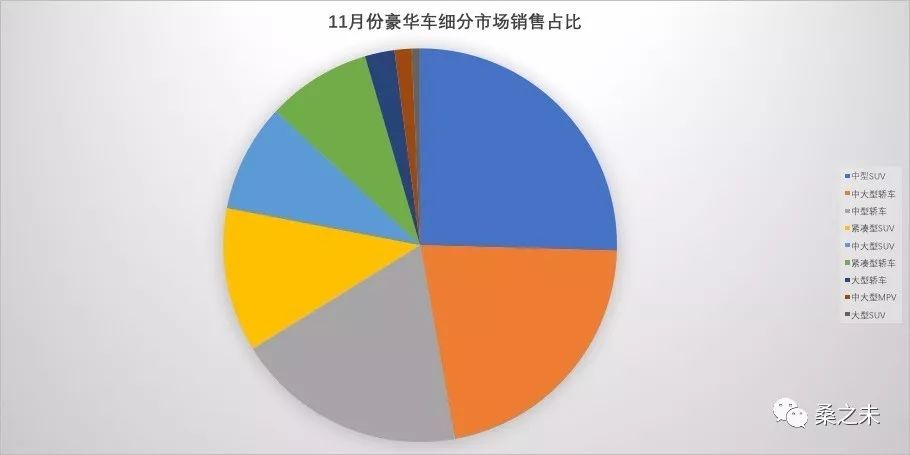

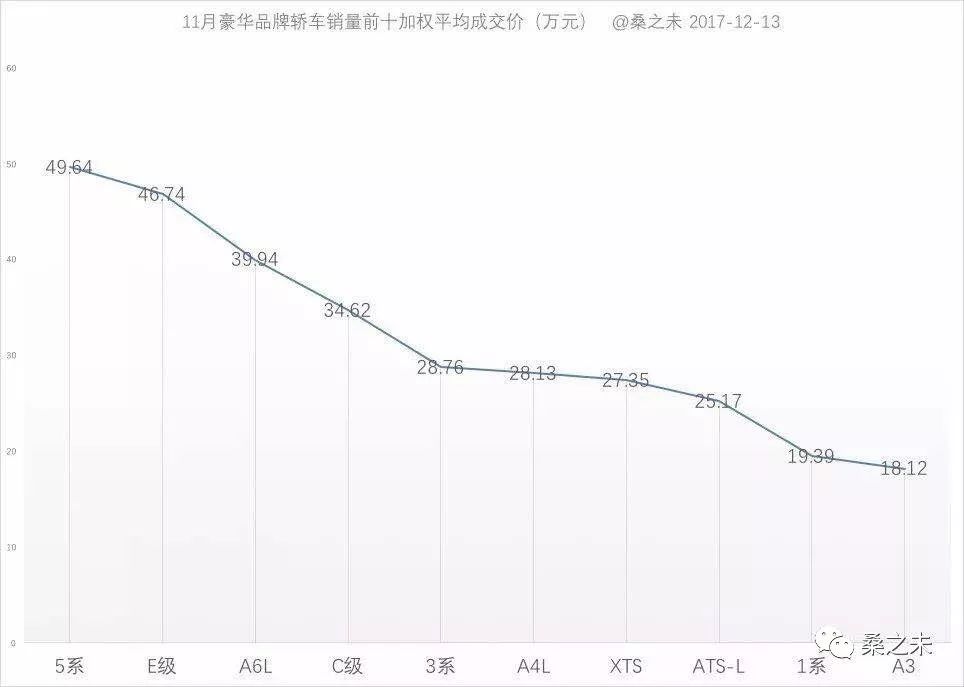

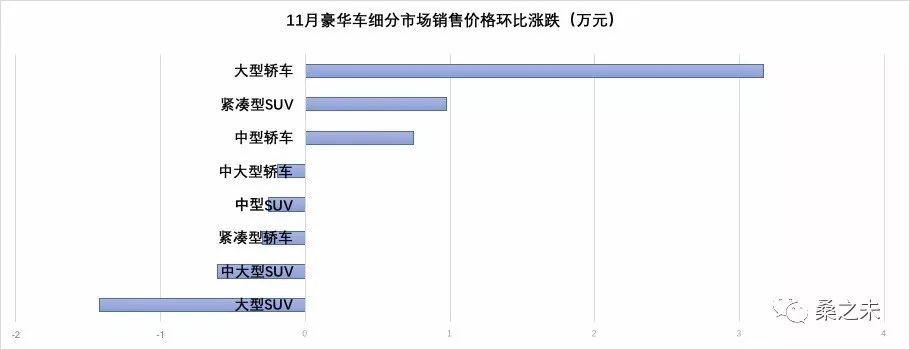

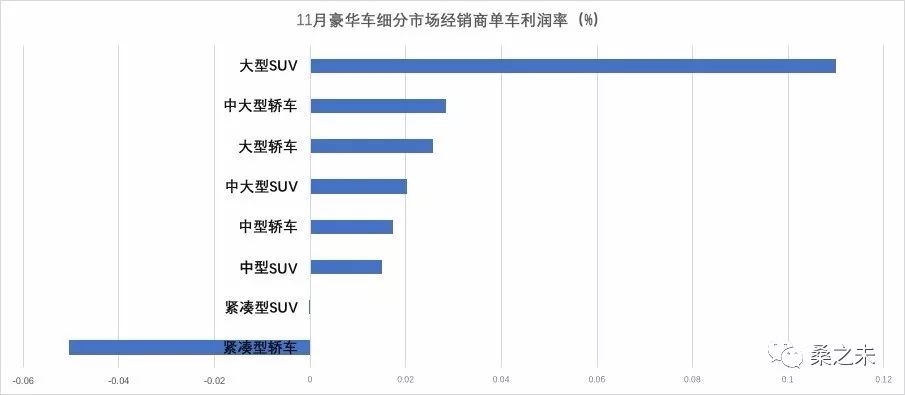

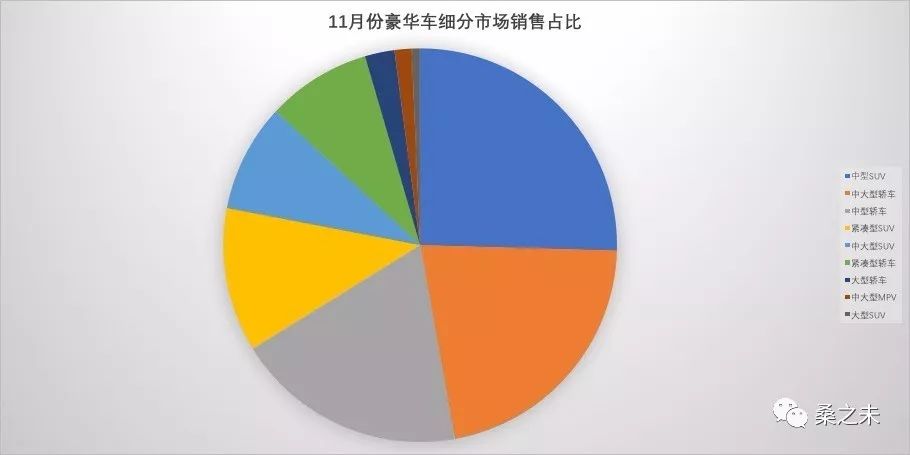

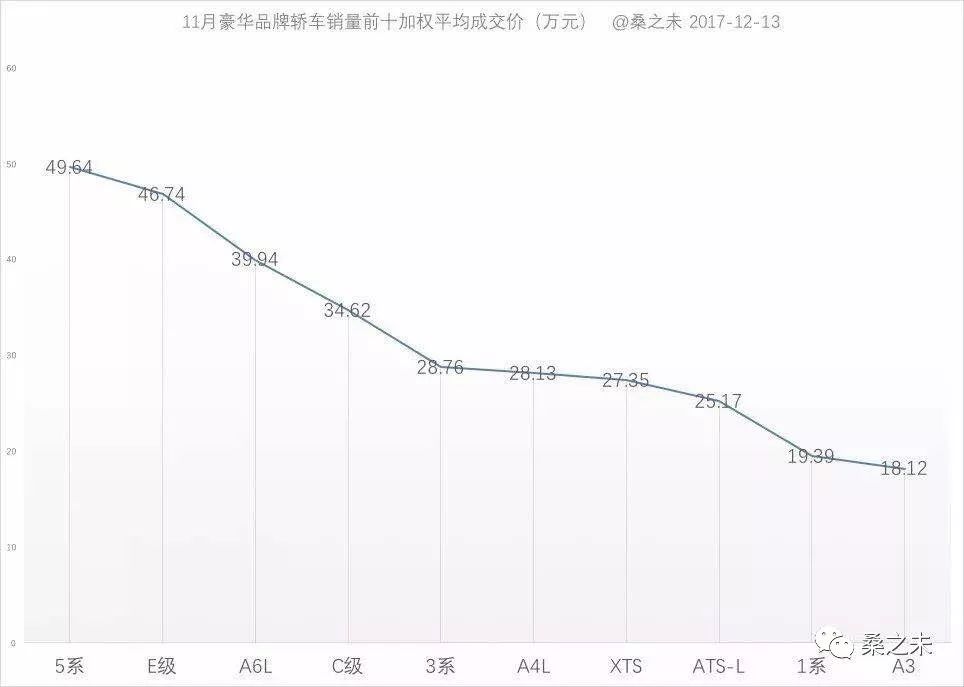

在细分市场方面,11月中大型轿车市场价格环比增幅最大,主要是小改款的奔驰S级以及奥迪A8L小改款上市,提升了销售单价所致。奥迪10月份推出的30周年型系列车型,在增加了配置的同时,也提升了奥迪所在细分市场的成交价。各细分市场新车利润方面,只有紧凑级轿车利润为负,这个级别以奥迪A3、宝马1系为主。大型SUV虽然利润高,但是销售数量比较少;中型轿车、中大型轿车、中大型SUV、中型SUV这四类细分市场,销量大,经销商新车销售利润都在2%上下,今年豪华车经销商利润向好。

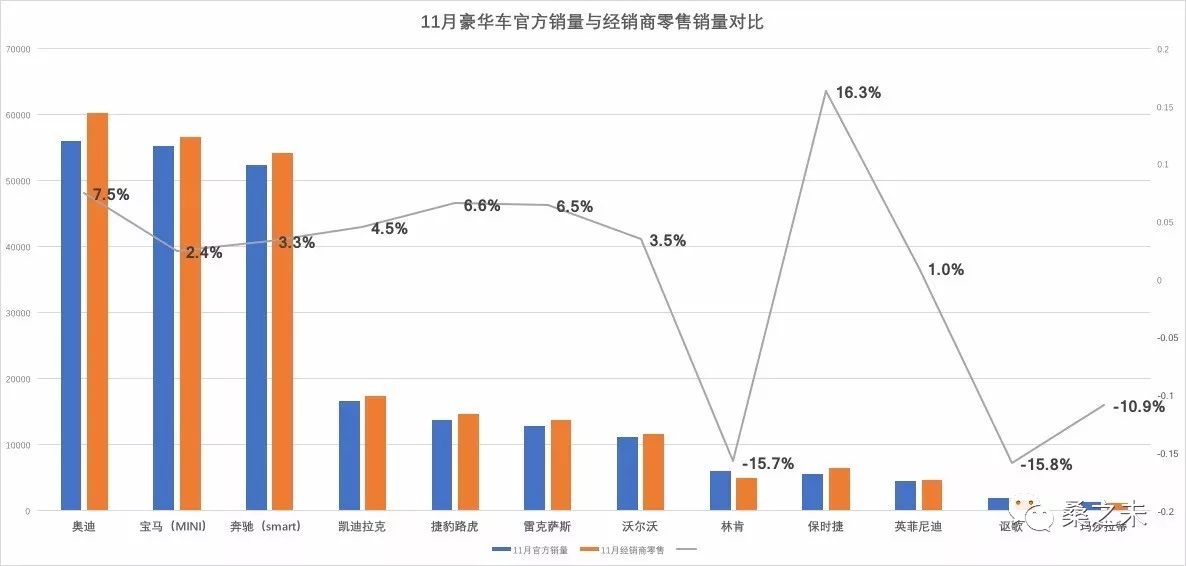

奔驰(含smart、福奔)11月官方公布的销量为52,412辆,同比增长20%,环比增长9.9%;今年累计销量560,154辆,增长26.0%;11月经销商零售近5.4万辆,环比上涨9.1%,奔驰11月市场份额为2.14%,份额降0.12;经销商库存深度微降,经销商客流-6.3%;本月奔驰品牌加权平均成交价比上个月有所上涨,经销商新车利润环比上升1.23%;奔驰加权平均成交价接近50万元,在ABB中最高;C级、E级在成交时经销商多以赠送保险、保修方式促成交,经销商真实利润有所下降;奔驰C级、E级分别成为11月豪华车经销商零售市场销量第四名、第五名,销量均过万。

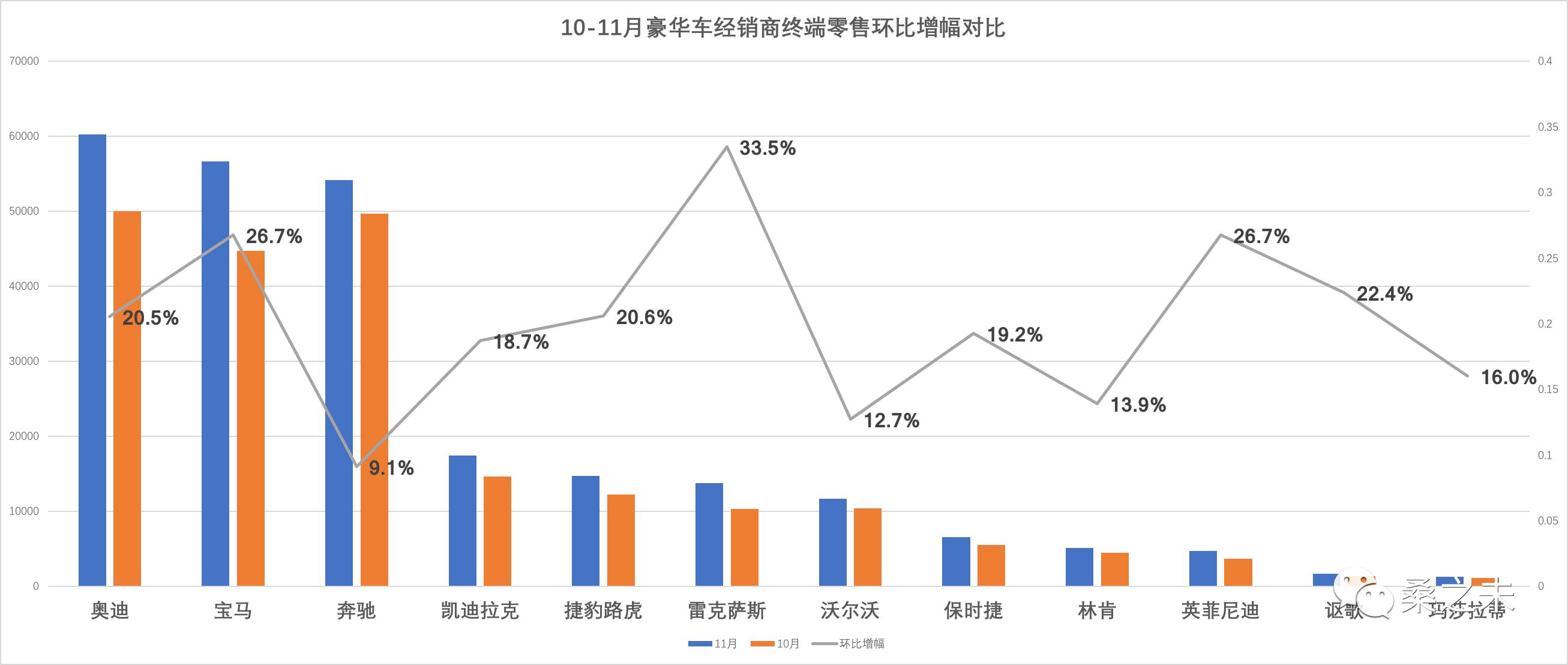

宝马(MINI)11月官方公布的销量为55,293辆,同比增长2.0%,环比增长2%;今年累计542,362辆,增长14.7%;11月经销商零售近5.7万辆,环比上涨26.7%,宝马市场份额微增为2.24%,经销商库存深度环比下降,经销商客流环比微降,经销商新车利润环比上升1.16%,连续4个月攀升;本月宝马5系经销商开票价格保持稳定,但经销商通过赠送保险、维修保养、贷款手续费方式让利给消费者,宝马厂家并没有给予额外补贴。宝马5系自6月份上市以来,11月经销商零售超过1万辆,今年5系的价格也保持稳定,明年1季度随528上市特别版清库完成后,宝马525上市将会对宝马5系的销量提供支持。

年末中大型车细分市场价格有所波动,宝马5系与奔驰E级成交价格重叠,使得两者面对同一消费群体。部分奔驰经销商年末任务完成,开始积累明年订单,并给予消费者一定优惠;这对没有完成今年销售任务的奔驰经销商产生一定的压力,没有完成任务的经销商也只能提供更多的折扣希望将用户当月转化;价格上的波动,也影响了宝马经销商的销售价格体系,不过这种竞争格局只是暂时的,并不是长期现象。

本月宝马3系、5系成为11月豪华车经销商零售市场销量第六名、第三名。宝马X1成为豪华车SUV市场的第二,X5销量排名第七,销量超过5500辆,环比增长29%;宝马5系、X1销量排名均上升。

奥迪11月官方公布的销量为56,008辆,同比增长6.5%,环比增长4.4%,今年累计526,51辆,增长-2.1%;11月经销商终端零售再次超过6万辆,环比增长21%,11月市场份额2.38%,经销商库存深度环比下降,经销商客流环比-3.87%,经销商新车利润环比增长0.62%至-3.64%,10月推出的30周年年型版系列车型,增加了配置,提升了成交价格。本月奥迪品牌加权平均售价近35万元,2018年奥迪A6L、Q5等车型换代上市,奥迪的价格体系有望在往上提升;奥迪A6L以1.38万辆成为11月豪华车经销商零售市场销量冠军,奥迪A4L位居第二,奥迪Q5、Q3分别成为豪华车SUV市场的第一和第三。

凯迪拉克11月官方公布的销量为16,629辆,同比增长23%,环比下降2.3%;今年累计159,407辆增长56%;11月经销商终端零售为1.7万辆,环比增长18.7%,11月市场份额0.69%,经销商库存深度微降,经销商客流环比-2.44%,厂家返利支持增加0.95%,经销商新车利润增加0.84%至-2.17%;本月凯迪拉克品牌平均售价为30.86万元,比上个月价格下降6400元;本月凯迪拉克零售量的增加进一步减轻了经销商库存,厂家增加返利,使得经销商新车零售有利润。凯迪拉克今年的策略是做好三款车的销量,在轿车市场用ATS-L、XTS采取高定价,大幅度折扣,大尺寸车身、高配置与竞品展开差异化竞争;XT5成交价位在33-36万之间与奥迪Q5重叠,市场折扣在15-17%左右,和竞品对比优势是车型比较新,但经销商利润比较少,明年随多款中型SUV上市,XT5成交价估计会进一步走低。

捷豹路虎11月官方公布的销量为13,808辆,同比增长19%,环比增长12.1%;今年累计130,796辆增长24%;11月经销商终端零售为近1.47万辆,环比增长21%,11月市场份额0.58%,经销商库存深度下降0.43。本月路虎、捷豹品牌平均售价和经销商新车利润均微增。

雷克萨斯11月官方公布的销量为12,896辆,同比增长27%,环比增长3.6%;今年累计119,831辆增长22%;11月经销商终端零售为1.4万辆,环比增长33.5%,11月市场份额为0.54%;本月雷克萨斯品牌平均售价为42万元,比上个月价格有所下滑,雷克萨斯发布了旗舰车型LS,2018年将进入一个完整销售年份,会提升整体价位。

沃尔沃11月官方公布的销量为11,259辆,同比增长24%,环比增长4.8%;今年累计104,344辆增长29.2%;11月经销商终端零售近1.2万辆,环比增长12.7%,11月市场份额0.46%,经销商库存深度微降;本月沃尔沃品牌平均售价为33.7万元,比上个月价格微升,经销商新车利润上升1.8%至-2.67%。 沃尔沃在12月末发布新款XC60.

保时捷11月销量为5,598辆同比增长11.6%,环比增长-14.3%;今年累计66,220辆,增长10.1%;11月经销商终端零售为6510辆,环比增长19.2%,11月市场份额0.26%,经销商库存深度微增;经销商客流环比增长3.88%;本月保时捷品牌平均售价为79.3万元,环比上涨3.89万;本月911、Macan、Panamera交付辆环比降幅较大,带动整体价格上涨;保时捷新款卡宴11月份上市,新增配置并提高了指导价,加上老款清库折扣加大,引发消费者观望。

林肯11月官方公布的销量为6,006辆,同比增长70%,今年累计51,735辆增长83%;11月经销商终端零售为5062辆,环比增长13.9%;环比微降,经销商新车利润下滑0.75%,11月市场份额0.2%;本月林肯品牌加权平均售价为39.77万元,比上个月价格下跌6800元;林肯售价下滑,说明经销商互相竞争激烈,销售难度增加;林肯调整区域管理层后,面临一些新问题需要解决。

英菲尼迪11月官方公布的销量为4,608辆,同比增长15%,今年累计42,585辆,增长10.4%;11月经销商终端零售为4655辆。环比增长26.7%;本月英菲尼迪品牌平均售价为30.82万元。明年上半年国产Q50L中期改款,下半年全新QX50换代,两款车型也是目前豪华车细分市场销量最大的车型,明年英菲尼迪销量将会有很大的提升。

玛莎拉蒂11月官方公布的销量为1,400辆,同比增长-9.7%,今年累计13,008辆,同比增长35.2%,环比增长16.7%;经销商终端零售为1248辆,环比增长16.0%,11月市场份额0.05%;玛莎拉蒂今年虽然高速增长,但经销商库存在豪华车品牌中偏高,经销商新车利润没有多大起色。

讴歌11月官方公布的销量为1,931辆,同比增长40.1%,今年累计14,102辆,增长125.9%;经销商终端零售为1625辆,环比增长22.4%,11月市场份额0.06%,经销商库存深度1.4,本月讴歌品牌平均售价为27.61万元。讴歌只有一款国产车型CDX,11月经销商零售量为1294辆,环比增长15.5%,在豪华车中,上市1年每月销量为1000台左右,这款车型可以归类为失败车型,由于讴歌只有一款主力车型销售,销量少,没有售后支撑,无法保证一家4S店生存,在渠道发展上,经销商多数持观望态度,有消息称,讴歌也许会选择在广汽本田店里销售讴歌。

本篇文章笔者着重介绍了部分品牌经销利润、库存系数数据等,文中提及的具体数据不再披露,仅限内部人士及订阅用户分享(经销商新车利润计算公式为GP2:(进销差+全部返利)/整车销售收入)。笔者每月对部分国内豪华车经销商进行调研,覆盖东北、华北、华东、华南、华中、西南、西北等经销商集团,所调查的结果仅反应部分经销商状态,不代表厂家;数据结果仅供参考。

版权声明:本文系@桑之未 #原创首发# 转载或改编请与本人沟通,如有任何侵权行为,侵权者将承担相应的法律责任。汽车行业人士留言可以索取本人微信号码,更多行业信息查阅朋友圈分享内容。2017-12-23 北京

Sang Zhiwei: The Ranking of Sales Volume of Luxury Cars Becomes Clear, the Overall Sales Volume of Mercedes Benz Expetected to Exceed 600,000 -Data Analyses Luxury Brands Market(14)

Written by / Sang Zhiwei

Insight into the Chinese Brand Market

Report | Data | Consulting

Keywords: Luxury brand market, sales volume of dealers, market share, new car profit of dealers

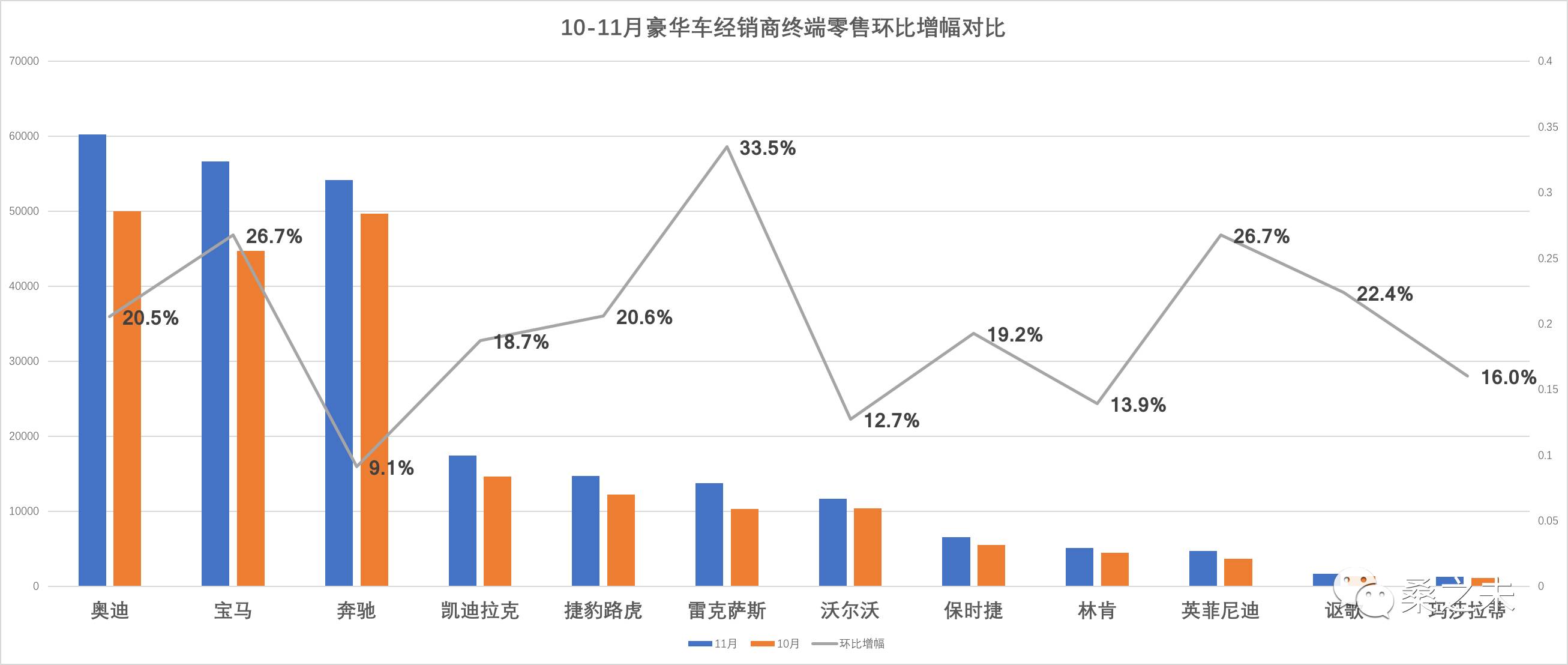

Comparison of the month-over-month growth of official sales volume of luxury cars from October to November

In November 2017, the officially announced sales volume of 12 luxury car brands was 237,848, up by13.1% YoY and 6.5% month over month. (In October, there was 1 week of effective sales days less due to the long holidays of National Day). The sales volume of the retail market of dealers was 232,000, and the market share of luxury cars was 11%. From January to November, the accumulative sales volume was 2,331,062, up by 17.5% YoY. In November, the growth of the luxury car market remained stable. It is expected that in December the sales volume of luxury cars will still be more than 200,000, the accumulative sales volume of the year will be more than 2,500,000, and the market share will be around 11%.

Sales volume and YoY growth of luxury cars in November / Sang Zhiwei, December 21st

Sales volume and YoY growth of luxury cars from January to November / Sang Zhiwei, December 21st

There is only 1 month before the end of sales of this year. It is still unknown who will be the sales champion. The accumulative sales volume of this year of Mercedes Benz as of November (including Smart and Fujian Benz) was 560,154; that of BMW (including MINI) was 542,362; and that of Audi was 526,518. Calculated by the sales volume of a single brand, Audi was ahead of Mercedes Benz and BMW. The sales volume of Audi in 2016 was 589,000. It is expected to reach about 590,000 this year. Mercedes Benz and BMW have achieved the goal of sales volume of this year. In December the sales volume will be around 50,000. Calculated by the total sales volume, it is expected that in 2017 Mercedes Benz will be the first. Calculated by the sales volume of a single brand, Audi will be still the first. In fact, the sales figure is not everything. The quality of sales is the key.

1.Accumulative sales volume of Mercedes Benz (Smart and Fujian Benz), BMW (MINI) and Audi from January to November.

2.Accumulative sales volume of a single brand of ABB from January to November / Sang Zhiwei, December 21st.

In terms of market segment, in November the month-over-month growth of market price of middle-and-large-sized sedans was the biggest, mainly because small modified Mercedes S-Class and small modified Audi A8L were launched and the unit price was increased. 30th anniversary series of models launched by Audi in October not only increased the configuration, but also increased the transaction price of Audi in the market segment. In terms of profits of new car in the market segments, only the profit of compact sedan was negative. This class was dominated by Audi A3 and BMW 1-series. Although large-sized SUV had high profits, the sales volume was small; and the sales volumes of middle-sized sedans, large-and-middle-sized sedans, large-sized SUVs and middle-sized SUVs were big, and the profit of new car of dealers was around 2%. This year, the profits of luxury cars of dealers were good.

The month-over-month rise and fall of sales prices of luxury car segments in November (RMB10,000).

Unit Profit rate of dealer in the luxury car market segment in November (%).

Sales proportion of luxury car market segments in November.

Mercedes Benz

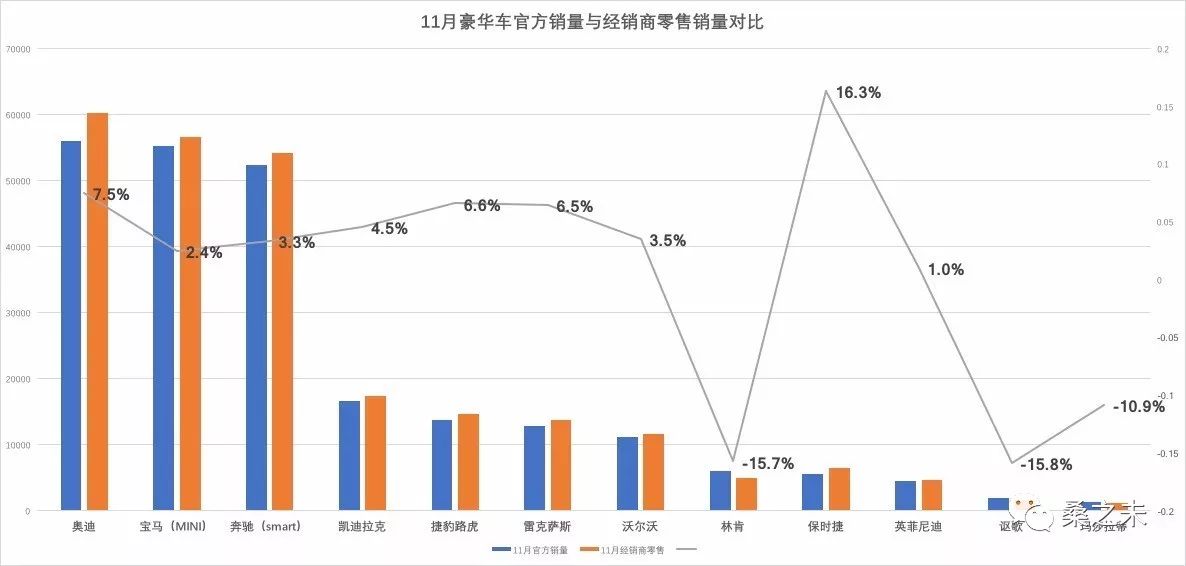

The officially announced sales volume of Mercedes Benz (including Smart and Fujian Benz) in November was 52,412, up by 20% YoY and 9.9% month over month; the accumulative sales volume of this year was 560,154, up by 26.0%; in November the retail of dealers was nearly 54,000, up by 9.1% month over month; the market share of Mercedes Benz in November was 2.14%, down by 0.12; the dealer inventory depth decreased slightly, and the customer flow of dealers rose by -6.3% month over month; this year the weighted average transaction price of Mercedes Benz brand was RMB493,000, higher than that of last month, and the dealer's profit of new car rose by 1.23% month over month; dealers often promoted transactions of C and E through free insurance and warranty, dealer's real profit declined; and the sales volume of Mercedes Benz C and E ranked the fourth and fifth in the retail market of luxury car dealers in November, respectively, and their sales volume was over 10,000.

The officially announced sales volume of BMW (MINI) in November was 55,293, up by 2.0% YoY and 2% month over month; the accumulative sales volume of this year was 542,362, up by 14.7%; in November the retail of dealers was nearly 57,000, up by 26.7% month over month; in November the market share of Mercedes Benz slightly increased to 2.24%, the dealer inventory depth decreased month over month, the customer flow of dealers decreased slightly, the dealer's profit of new car rose by 1.16% month over month, rising for 4 consecutive months; this year the average price of BMW brand was RMB404,400; and this month the invoice price of BMW 5-series dealers remained stable, but the dealers surrendered part of the profit to consumers through free insurance, maintenance and loan service charge, and BMW manufacturer did not give additional subsidies. Since BMW 5-series were launched in June, retail of dealers in November was more than 10,000, and its price was stable this year. In Q1 of next year, as the inventory clearing of special version of 528 is completed, the launching of BMW 525 will provide support to the sales volume of BMW 5-series.

At the end of the year, the prices in the market segment of middle-and-large-sized cars fluctuated, and the transaction prices of BMW 5-series and Mercedes Benz E-Class overlapped, so that the two faced the same consumer group. Some Mercedes Benz dealers had completed their tasks at the end of the year, and began to accumulate orders for next year and give consumers discount; this exerted a certain pressure on Mercedes Benz dealers which did not complete their sales tasks, who could only provide more discounts to convert users in the current month; and the price fluctuations also affected the sales price system of BMW dealers. However, this competition pattern was only temporary, but not a long-term phenomenon.

This month, the sales volume of BMW 3-series and 5-series ranked the sixth and the third in the retail market of luxury car dealers. The sales volume of BMW X1 ranked the second in the luxury SUV market. The sales volume of X5 ranked the seventh and was 5,500, up by 29% month over month; and the ranking of sales volume of BMW 5-series and X1 was on the rise.

Audi

The officially announced sales volume of Audi in November was 56,008, up by 6.5% YoY and 4.4% month over month; the accumulative sales volume of this year was 526,51, up by -2.1%; in November the retail of dealers was over 60,000 again, up by 21% month over month; the market share in November was 2.38%, the dealer inventory depth decreased month over month, the customer flow of dealers rose by -3.87% month over month, the dealer's profit of new car rose by 0.62% month over month to -3.64%; and 30th anniversary series of models launched in October not only increased the configuration, but also increased the transaction price. The average selling price of Audi brand was RMB347,000 this month; Audi A6L became the sales champion in the retail market of luxury car dealers in November with the sales volume of 13,800, Audi A4L ranked the second, and Audi Q5 and Q3 ranked the first and the third in the luxury SUV market, respectively.

Comparison of month-over-month growth of terminal retail of luxury car dealers from October to November.

Cadillac

The officially announced sales volume of Cadillac in November was 16,629, up by 23% YoY and down by 2.3% month over month; the accumulative sales volume of this year was 159,407, up by 56%; in November the retail of dealers was 17,000 again, up by 18.7% month over month; the market share in November was 0.69%, the dealer inventory depth decreased slightly, the customer flow of dealers rose by -2.44% month over month, the manufacturer's rebate support increased by 0.95%, the dealer's profit of new car rose by 0.84% to -2.17%; this month the average selling price of Cadillac brand was RMB308,600, RMB6,400 lower than the price of last month; and this month the retail of Cadillac further reduced the dealer inventory, and the manufacturer increased the rebate, so that there were dealer's profits of new car. This year Cadillac's strategy was to increase the sales volume of three models, and have a differentiated competition with competitive products with high price, a large discount, large-sized car body and high configuration of ATS-L and XTS in the sedan market; SRX's transaction price was RMB330,000-360,000, overlapping with that of Audi Q5, and market discount was 15-17%, but dealer's profit was relatively little. The competitive advantage with competitive products is the new model. Next year, SRX will be launched with several middle-sized SUVs, and its transaction price is expected to further decline.

Jaguar Land Rover

The officially announced sales volume of Jaguar Land Rover in November was 13,808, up by 19% YoY and 12.1% month over month; the accumulative sales volume of this year was 130,796, up by 24%; in November the retail of dealers was nearly 14,700, up by 21% month over month; and the market share in October was 0.58%, and the dealer inventory depth decreased by 0.43. This year the average selling price and dealer's profit of new car of Land Rover and Jaguar brand both rose slightly.

Lexus

The officially announced sales volume of Lexus in November was 12,896, up by 27% YoY and 3.6% month over month; the accumulative sales volume of this year was 119,831, up by 22%; in November the retail of dealers was 14,000, up by 33.5% month over month, the market share in October was 0.54%; and this month the average selling price of Lexus brand was RMB420,000, lower than that of last month. Lexus launched the flagship model LS. In a full year of sales of 2018, the overall price will increase.

Comparison of official sales volume and retail sales of dealers of luxury cars in November.

Volvo

The officially announced sales volume of Volvo in November was 11,259, up by 24% YoY and 4.8% month over month; the accumulative sales volume of this year was 104,344, up by 29.2%; in November the retail of dealers was nearly 12,000, up by 12.7% month over month, the market share in November was 0.46%, the dealer inventory depth decreased slightly; this year the average price of Volvo brand was RMB337,000, a little higher than that of last month, and dealer's profit of new car rose by 1.8% to -2.67%. Volvo will launch the new XC60 at the end of December.

Porsche

The officially announced sales volume of Porsche in November was 5,598, up by 11.6% YoY and -14.3% month over month; the accumulative sales volume of this year was 66,220, up by 10.1%; in November the retail of dealers was nearly 6,510, up by 19.2% month over month, the market share in November was 0.26%, the dealer inventory depth decreased slightly; the customer flow of dealers rose by 3.88% month over month; this year the average price of Porsche brand was RMB793,000, up by RMB38,900 month over month; this month, the month-over-month growth of the number of 911, macan and PANAMERA delivered was relatively big, driving the overall price rise; new Porsche Cayenne was launched in November, there was new configuration, the guidance price increased, and the discount of old models increases to clear inventory, causing consumers' wait-and-see attitude.

Lincoln

The officially announced sales volume of Lincoln in November was 6,006, up by 70% YoY; the accumulative sales volume of this year was 51,735, up by 83%; in November the retail of dealers was 5,062, up by 13.9% month over month; dealer's profit of new car slightly decreased by 0.75% month over month; the market share in November was 0.2%; this year the weighted average price of Lincoln brand was RMB397,700, RMB6,800 lower than that of last month; the decline of sales price of Lincoln indicated that dealers' competition was fierce and the difficulty of sales increased; and after adjustment of regional management, Lincoln faced some new problems to be solved.

Infiniti

The officially announced sales volume of Infiniti in November was 4,608, up by 15% YoY; the accumulative sales volume of this year was 42,585, up by 10.4%; in November the retail of dealers was 4,655, up by 26.7% month over month; and this year the average selling price of Infiniti brand was RMB308,200. In the first half of next year domestic Q50L will be modified in the middle term, and in the second half of next year new QX50 will be launched. The sales volume of the two models ranked the first in the luxury car market segment currently. Next year, the sales volume of Infiniti will be greatly improved.

Maserati

The officially announced sales volume of Maserati in November was 1,400, up by -9.7% YoY; the accumulative sales volume of this year was 13,008, up by 35.2% month over month and 16.7% YoY; the retail of dealers was 1,248, up by 16.0% month over month; the market share in November was 0.05%; this year the sales volume of Maseratiincreased at a high speed, but the dealer inventory was high in the luxury car brands, and dealer's profits of new car did not increase.

Acura

The officially announced sales volume of Acura in November was 1,931, up by 40.1% YoY; the accumulative sales volume of this year was 14,102, up by 125.9%; the retail of dealers was 1,625, up by 22.4% month over month; the market share in November was 0.06%, the dealer inventory depth was 1.4, and this year the average selling price of Acura brand was RMB276,100. Acura only has one domestic model CDX. In November, the retail of dealers was 1,294, up by e 15.5% month over month. In the luxury cars, 1 year after its launching, the monthly sales volume was about 1,000. This model can be classified as a failing model. Acura only has one main model, the sales volume is small, there is no support of customer service, and the survival of a 4S store cannot be guaranteed, so in the development of channels the majority of dealers have wait-and-see attitude. There is news that Acura may choose to sell Acura in stores of Guangqi Honda.

In this article the author focused on sales profits, inventory coefficient and other data of some brands. The specific data mentioned in the article will not be disclosed, and is only shared with insiders and subscribing users (the calculation formula of dealer's profit of new car is as follows. GP2: (purchase and sale price differential + all rebates) / sales revenue of a vehicle). The author conducted monthly survey on some luxury car dealers in China, covering Northeast, North China, East China, Southern China, Central China, Southwest, Northwest and other dealer groups. The results of the survey only reflect some dealers' status and do not represent manufacturers; and the results of data are for reference only.

Copyright statement:This article is anoriginal article published by Sang Zhiwei for the first time. For reproduction or adapting, please communicate with the author. In case of any infringement, the infringer will bear the corresponding legal responsibilities. Readers in the auto industry can leave a message and ask for the author's personal WeChat number. For more information of the industry, refer to the content shared in Circle of Friends. Dec.23th, 2017, Beijing.

? ? ? MORE READING ? ? ?